Founded in 1856, Burberry was a luxury brand that best represented Britain. The business specialised in trench coats and now expanded to broader accessories and fashion clothing. However, it has lost its brand identity over the years, which is evident by the fact that the company has gone through three chief creative directors and three logos in a decade. The share price has been in free-fall mode since last year’s peak after management lowered the guidance and performed worse than its luxury peers’ growth.

This investment memo aims to break down the analysis into 3 levels from a top-down perspective: luxury market structure, industry peer trends, and Burberry’s business fundamentals. Through analysing these 3 key lenses, I arrive at 3 key debates that I believe will determine the conclusion on the investment case for Burberry.

Ultimately, I believe Burberry presents a rare opportunity for high-conviction contrarian investors who can see the deep value in an irreplaceable century-long luxury brand undergoing a multi-year business turnaround.

Part 1 - Luxury market structure

“You sold your soul to the devil when you put on your first pair of Jimmy Choos. I saw it.” – The Devil Wears Parada

People are addicted to luxury goods.

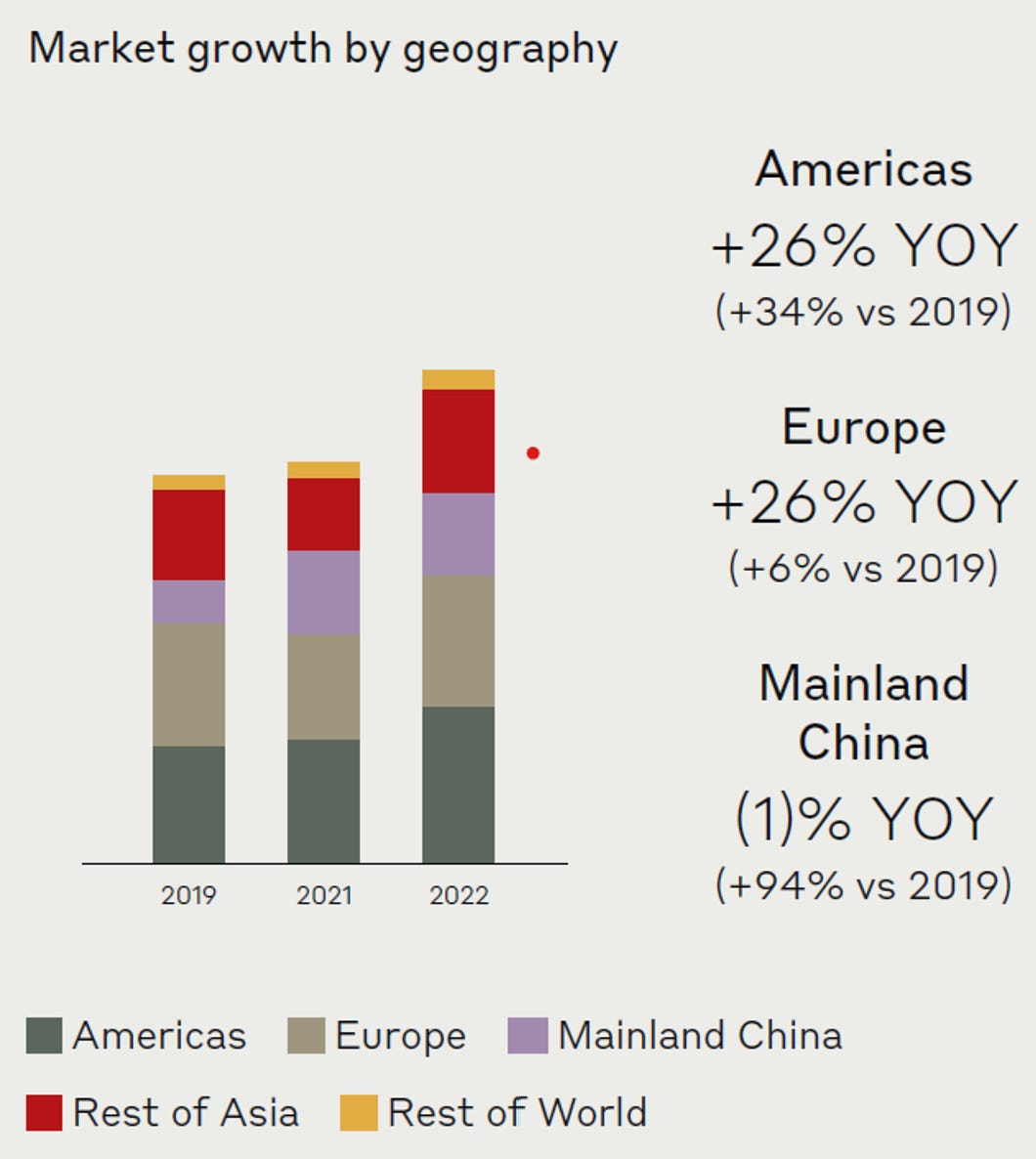

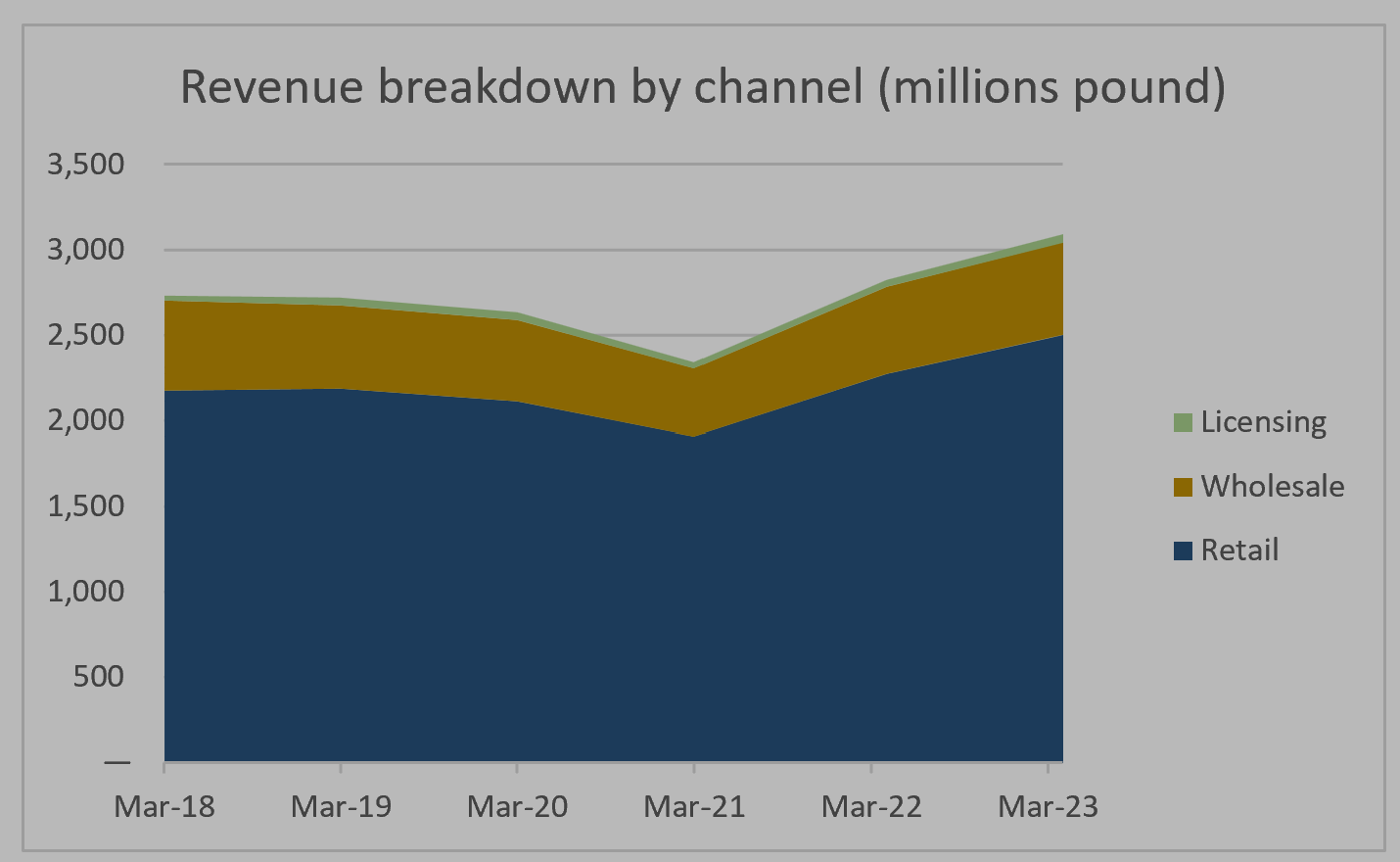

Source: Burberry2022/23 annual report

As the global economy grows, more wealth is being created and the new riches can’t stop buying. Impressive double-digit growth in developed countries despite a slowdown in China due to its slow recovery from lockdown. This growth is driven by sustained local consumption and a rebound in tourist activity.

Structurally, China and other Asian countries like Japan and Korea have been steadily increasing their demand as their middle- and upper-class populations grew at an extraordinary rate.

According to McKinsey, in 2021, there were about 100 million affluent Chinese families who were the target consumers of luxury brands. In 2025, it is expected to double to 200 million. This doubling of targeted demographic will remain a key driver for growth and is already reflected by the fact that most luxury brands generate around 30-50% of their revenue in the Asia Pacific region.

Whilst the market remains heavily weighted towards American and European shoppers as illustrated in the chart below, I see Asian buyers eventually overtaking European buyers by 2025.

Share of the personal luxury goods market worldwide in 2022, by consumer nationality

Source: Statista

The luxury market is not slowing down. As wealth becomes increasingly more concentrated in the hands of a few (see chart below), we will continue to see increased purchasing activities.

Source: Credit Suisse Global Wealth Databook 2021

Complementary to what is happening on a geographic level, demographically, we see the age of shoppers shifting towards Gen Z who was born between the mid to late 1990s and the early 2010s.

By generation, Gen Z and Gen Y customers grew their share of revenue from 44% in 2019 to 65% in 2022. Gen Z and Gen Alpha customers, born in the early 2010s, are expected to have the biggest impact on the development of the luxury market. Spending from these generations is anticipated to grow three times faster versus older generations until 2030, encouraged by an informed approach to luxury through popular culture and social media platforms. This demographic shift will be the key structural driver to sustaining the luxury market’s growth. It is important to highlight luxury brand’s value comes from the lifestyle/dream it is selling to its consumers, and this dream is carefully crafted through decades of branding and marketing. Post-2000, Gen Z and Gen Alpha grew up in a digitalised environment and a popular culture where they were constantly bombarded by luxury marketing. These luxury goods have embedded strong images into these young shoppers’ minds (consciously and subconsciously). I argue this makes them a radically different group of consumers from the previous generation who has generally less exposure to luxury branding, making Gen Z and Gen Alpha consumers stronger followers and buyers of luxury goods.

Luxury goods market size = Demographic size* average luxury goods price

Knowing we expect to see sustained volume growth in this market, now we shall examine the future of average selling price for luxury goods.

The quality of luxury goods is never the key driver for the increase in selling price. Price for luxury goods is not simply about tangible benefits as it also plays as a source of satisfaction or pride. Price becomes part of the value, and it is determined by the value obtained by the buyer in reflecting a personal, financial and cultural ability to pay a lot for a non-necessity. The behaviour of luxury consumers challenges traditional classic economic theory whereby higher prices should induce lower demand.

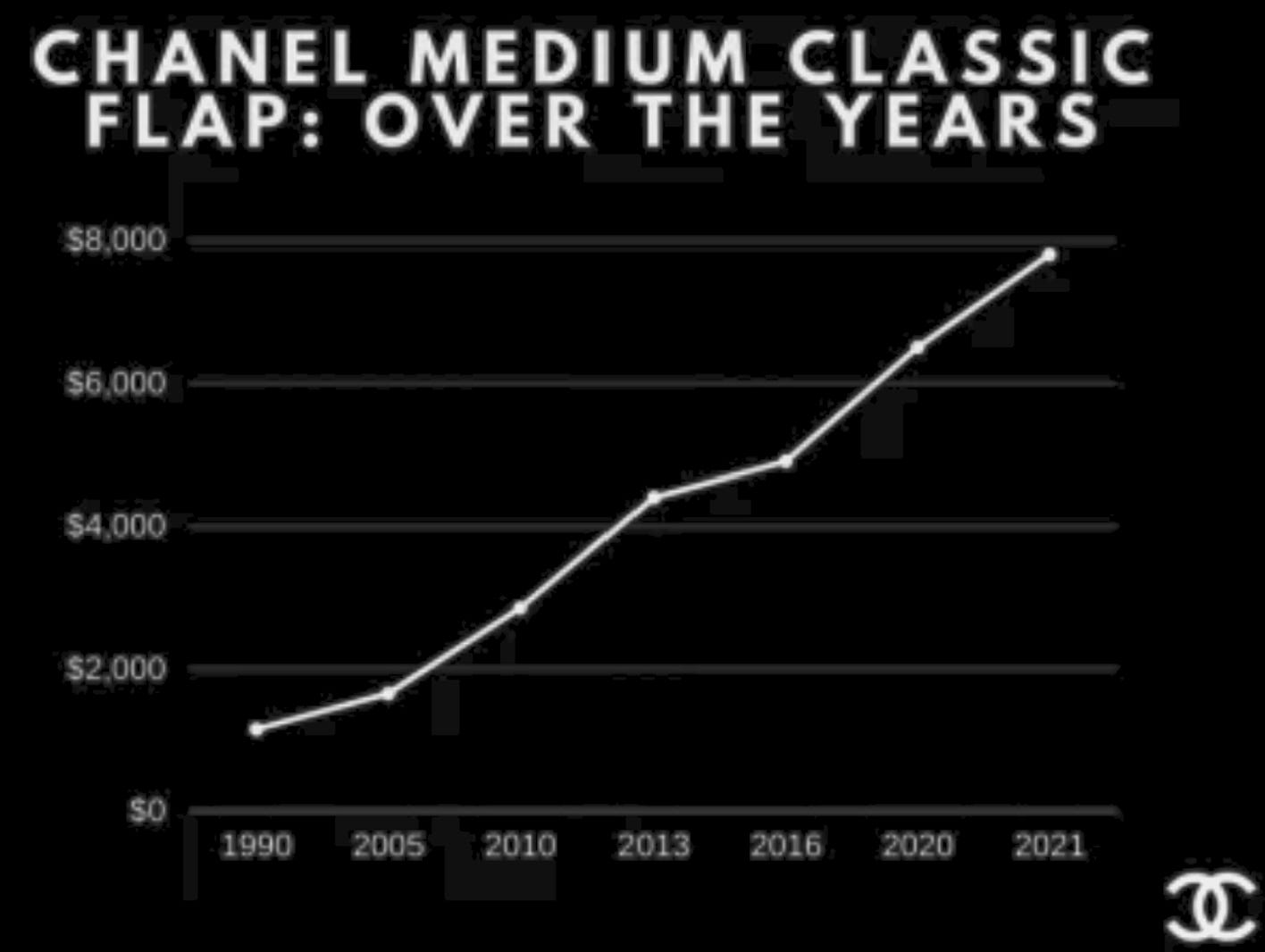

Historically, established luxury brands like Channel, can consistently grow not only the volume sold but also the average selling price at a rate substantially higher than inflation which is difficult for physical goods. According to the data company EDITED, average luxury prices are up by 25% since 2019.

Take Chanel, where handbag prices have more than doubled since 2016. The auction house Sotheby’s found a classic 2.55 Chanel bag sold for around $1,650 in 2008. In 2023, that figure from Chanel is closer to $10,200 (if the cost had risen in line with inflation over the 15 years, it would be expected to cost $2,359).

It is therefore not hard to see why I have a strong conviction that the luxury goods industry remains an attractive industry to allocate capital in despite all the recent hype in the tech industry.

Part 2 - How have luxury companies as a group performed given this backdrop?

Companies in the fashion industry sit on a spectrum but can be generally categorised into 4 categories:

a) Casual – this is your everyday fashion brands like Uniqlo, H&M, and Shein. Cheap, accessible and follows the fashion trend. They service the majority of the population.

b) Premium – brands that provide more functionality or offer high-quality goods than everyday fashion brands. Brands like Tumi, Hugo Boss, Coach, Calvin Klein

c) Aspirational luxury – brands that cater to the middle class and upper-middle class. It sells a lifestyle/dream but at a slightly more affordable price entry point to these consumers. However, generally, they are still vulnerable to macro-economics and discretionary spending due to most buyers being middle and upper-middle class. Brands like Gucci, Max Mara, and Prada. These brands are still somewhat influenced by the latest fashion trends.

d) High-end luxury – this is where it gets really interesting. Brands like Hermes, Chanel, Dior and Bottega Veneta play the role of fashion trendsetters. They are not only independent from a fashion perspective but also from an economic perspective given most of their consumers are the ultra-rich (they are not impacted by the macro-economics given their incredible wealth).

In this memo, I’d like to focus on aspirational luxury and high-end luxury brands. These companies have recently enjoyed an incredible surge in demand from COVID-19 but are now presented with concerns about decreasing consumer spending as economic conditions remain uncertain.

However, as a group, the companies seem to have performed alright despite the recent uncertainty (see below S&P global luxury index). This is masked by the massive performance difference between aspirational brands and high-end luxury brands.

S&P Global Luxury Index

Whilst high-end brands like Hermes performed consistently strong, more aspirational brands like Gucci which is owned by Kering and brands like Parada have struggled in recent years. This may come as a surprise since the start of the paper suggested double-digit growth in the luxury market. However, the reality is most of that double-digit growth has gone into the high-end luxury brands.

This stark contrast in companies' performance is reflective of the key rationale behind the M&A consolidation trend that’s been happening in the luxury market. With aspirational shoppers tightening their purse strings, luxury companies are looking to generate inorganic growth via M&A and execute opportunistic acquisitions in smaller brands whose share price has been depressed by market sentiment.

“Recognize the ultimate success comes from opportunistic, bold moves which, by definition, cannot be planned.” – Barbarians at the Gate: The Fall of RJR Nabisco

Recent headline transactions include New York-based fashion conglomerate Tapestry’s takeover of rival luxury firm Capri Holdings, the parent company of Versace and Michael Kors. The US$8.5 billion deal will see the companies’ six fashion brands – Coach, Kate Spade, Stuart Weitzman, Versace, Jimmy Choo and Michael Kors – congregate under one roof.

In July 2023, the French luxury Kering announced the acquisition of a 30% stake in Italian fashion label Valentino from Qatari fund Mayhoola. As part of the 1.7 billion euro deal, the fashion powerhouse will have the option to take full ownership of Valentino by 2028. The day after the Kering-Valentino deal was made public, Swiss luxury rival Richemont announced the acquisition of a controlling stake in Italian shoemaker Gianvito Rossi.

Just recently, LVMH’s buyout fund bought a big chunk of Tod’s, an Italian loafer maker, looking to take the company private, sparking a rally in luxury company prices as the market speculates on the next takeover target.

Burberry is one of the few large fashion houses left standing. Not to mention its unique British identity that is quite different to many of the portfolio brands owned by conglomerates like LVMH and Kering. It wouldn’t surprise me if executives at these companies are already plotting a potential opportunistic takeover of Burberry given its depressed share price.

Part 3 - Burberry – fortune favours the brave

“To be fearful when others are greedy, and to be greedy only when others are fearful” – Warren Buffet

What do all these high-level analyses mean for Burberry?

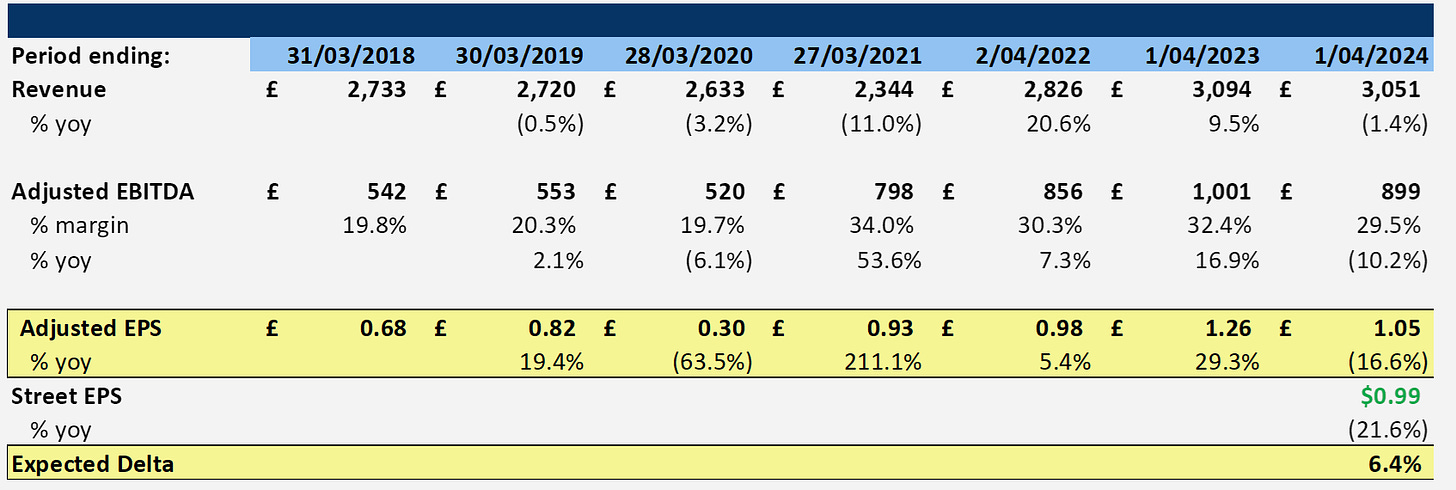

A quick historical financial snapshot of Burberry shows a worrying tale initially.

Note EBITDA is on a post-IFRS basis

Pre-pandemic, Burberry was struggling with growth. Its topline has been decreasing at low single digit since 2017. Whereas, competitors like LVMH and Hermes grew at the high single-digit to low double-digit annually during the same period. They also have a consistently higher EBITDA margin of around 30-40%, highlighting their strong pricing power relative to Burberry (20-30%).

This sustained underperformance is reflected in the market’s pricing of their share price.

To understand the driver of underperformance, it’s important to understand the history of Burberry over the last 20 years.

The brand is the most important asset to a luxury company because that is their true product. However, Burberry has failed to maintain a consistent image since its peak during the Christopher Bailey era (former chief creative director 2001 – 2018).

Christopher Bailey positioned Burberry as a conduit of the Britishness of the world, working with actors, musicians and artists to amplify his fashion message into one of cultural leadership. He is undisputed the most influential British designer back then and has transformed an antiquated coat maker into one of the world’s top luxury brands. He gave Burberry such momentum that it had a halo effect on the rest of British fashion, making London Fashion Week a draw again. During his time Burberry demonstrated consistent growth and increased from 200 pence a share in 2001 to 2,271 pence a share in 2018, achieving 10.4x growth in price achieving a compounded return of around 15% per year.

After he decided to leave Burberry in 2018, he was replaced by Riccardo Tisci who had a different set of fashion vision. Under Tisci’s leadership, Burberry underwent a rebrand. The logo was redesigned to a more hip modern look like Hugo Boss and Balenciaga.

This is also echoed in his ready-to-wear design which tried to resonate with the younger generation and reinvigorate Burberry’s brand to a new fashion landscape. However, the public hasn’t responded well to the new designs as evident in Burberry’s declining revenue pre-pandemic. Additionally, at the same time, from a business perspective, Burberry suffered from brand image damage from the controversy with Burberry burning bags, clothes and perfume worth millions, and large discounts in outlet stores (wholesale channels). All these created confusion in the message Burberry’s marketing aims to deliver to the consumers. We see Burberry’s brand positioning from a higher-end luxury brand fall to a more aspirational luxury brand, being more vulnerable to change in popular fashion trends and aspirational shoppers’ spending. Tisci ultimately left the company in Sep 2022.

The turbulent period of 2018-2022 ultimately led to the recent massive sell-off that began in May 2023 when Burberry’s weak US demand overshadowed China's rebound. Investors’ fear turned out to be justified as in the following quarters, Burberry announced a guidance downgrade and performed worse than other luxury brands amid a slowdown in aspirational luxury demand.

The stock fell from 2,475 pence per share in April 2023 to 1,319 pence per share in Feb 2024, a decrease of 47%~.

The story up until now paints a bleak picture for Burberry. Hedge funds are shorting, investors are selling, and consumer demand is slowing down.

Amidst all this, I believe Mr Market has now mispriced the fundamentals.

When I initially looked at Burberry back in late 2023, the share was in free fall. However, despite the decrease, it wasn’t attractive enough to justify the risk surrounding a business turnaround play.

However, things have changed now and at its current valuation, all these risks have been priced in.

My investment thesis: Burberry’s current valuation provides an asymmetrical opportunity to buy into a distinctively British brand that is irreplicable in the luxury goods landscape. The downside is capped with the safety guard of a very likely M&A offer.

The crux of the thesis is that luxury brand sells a lifestyle & a dream that requires time to build. Such brand power is built through continuous marketing and consumer interaction at a touchpoint of their journey. The value I see in Burberry’s is its brand which carries the weight of more than a century of British history. This is its core competitive advantage that separates it from its French and Italian luxury competitors and defends it against up-and-coming challengers who are new and shallow in heritage. The key now is management’s execution to unlock this untapped brand value.

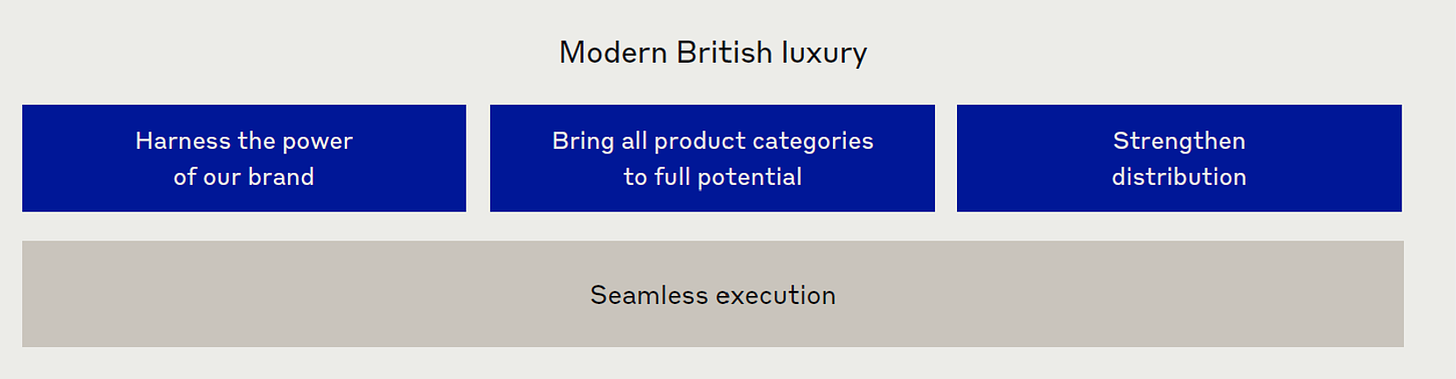

Luckily, the new management put in place in early 2022 is acutely aware of this issue. Below is the action plan highlighted in Burberry’s 2022/23 annual report.

The emphasis is clear, Burberry is re-branding to harness the British heritage. It is improving its brand communication through consistent marketing of Britishness and a new marketing campaign that features a new logo and new designs. It is shifting its revenue mix towards accessories like handbags that are higher in margin (50%+) and have a broader audience compared to clothing. It is refurbishing all direct-to-consumer stores to enhance consumer experience at all touchpoints and gradually reducing its wholesale revenue channels.

The new CEO has appointed Daniel Lee to be a key enabler of this change, the rising star in the fashion industry. He was appointed the chief creative director in 2022.

I believe he is the right designer to lead the change at Burberry. Previously, Daniel worked as the chief creative director at Bottega Veneta, tasked with receiving the brand following its recent period of stagnation. He introduced a successful line of accessories that modernised Bottega Veneta’s famous intreciatto technique. The success in business turnaround is evident in the 2019 British Fashion Awards where Bottega Veneta won Brand of the Year while Lee won “Designer of the Year”, “British Designer of the Year – Womenswear” and “Accessories Designer of the Year”.

Daniel Lee’s British heritage (born in Bradford, England) and experience in transitioning brands like Bottega Veneta from aspirational luxury to high-end luxury provides me with confidence in the execution of Burberry’s turnaround plan. Management has announced a medium goal of $4 billion British pounds in revenue and a long-term goal of $5 billion.

Valuation

LTM P/E

NTM P/E

On an LTM basis, P/E Burberry trades cheaply and NTM basis. The recent discrepancy (uptick of P/E NTM) is a consequence of the fact that analysts have further downgraded Burberry's EPS forecast after its January trading update which lowered guidance.

I have omitted comparative valuation analysis as I’ve always remained cautious with valuation done via other market price references. Especially considering this is a deep value case where comparable will not be indicative of fair value.

(Note I include multiple analyses in all my sum pages but I use them more for sense check. My valuation and analysis at its core is driven by DCF analysis which I believe best highlights intrinsic valuation. Additionally, the historical multiples in the EV/sales section, EV/EBITDA section are based on the current EV so it is more for sense check. It’s not its real past multiple.)

Based on the conservative forecast of a 10-year 4% revenue CAGR post 2024, an EBITDA margin of 24% at maturity state, WACC of 10% and TGR of 3.5%. I see Burberry’s fair value to be around 42.5% above its current price under this set of assumptions.

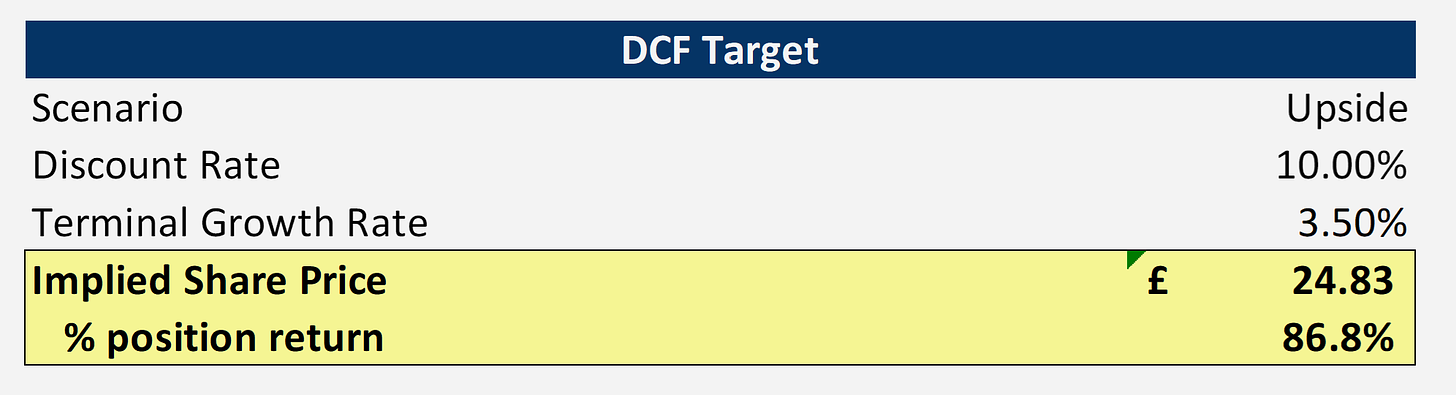

In my most bullish case, if Burberry’s transformation was a greater success than expected and transcends the brand to a high-end luxury instead of an aspirational luxury brand. I see a potential 10-year 7% revenue CAGR post-2024, an EBITDA margin of 25%, I see a price target of around 24.83 which suggests an 86.8% upside.

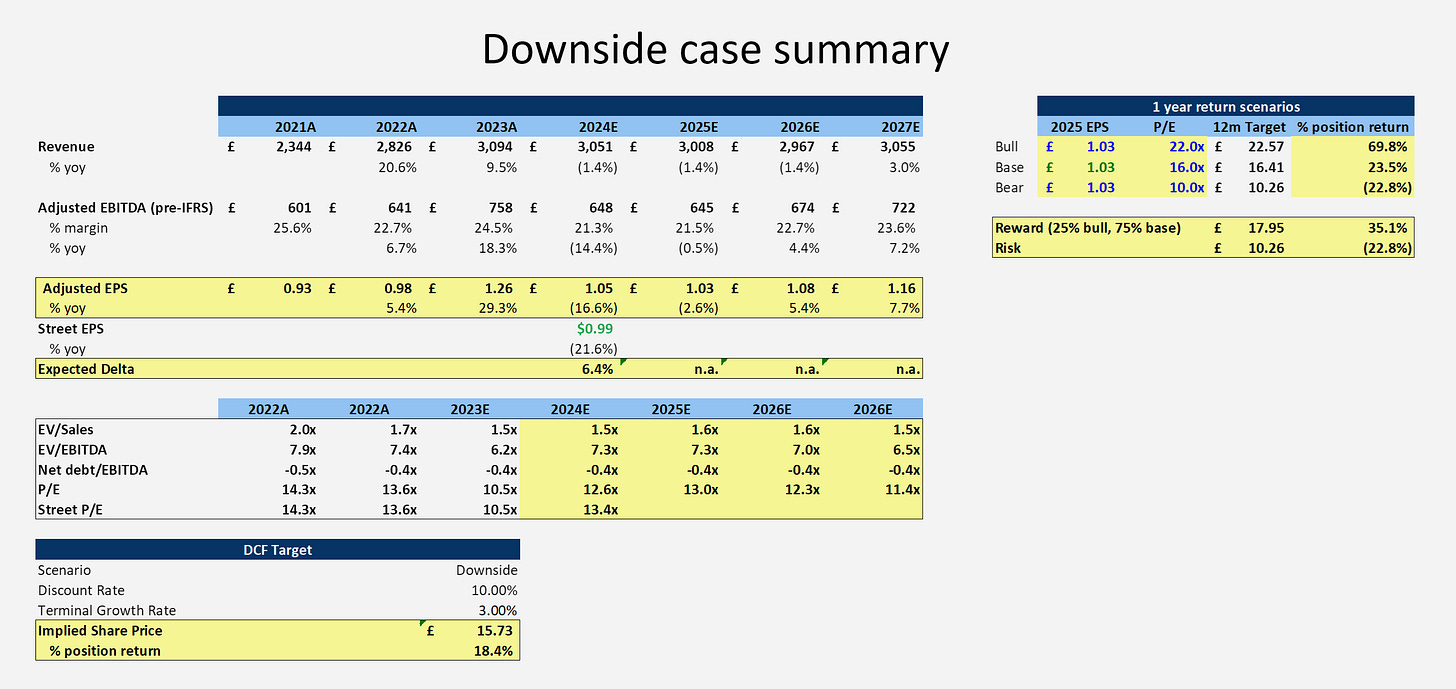

From a bearish case scenario (see below), if Burberry fails to tap into its brand asset and revenue declines by -1.4% for the next 3 fiscal periods and then grows at 3.5% annually for the 7 years after, at a 10% discount rate and 3% TGR, the target price is 16.27 pound per share which still presents an 18.4% upside in terms of intrinsic value.

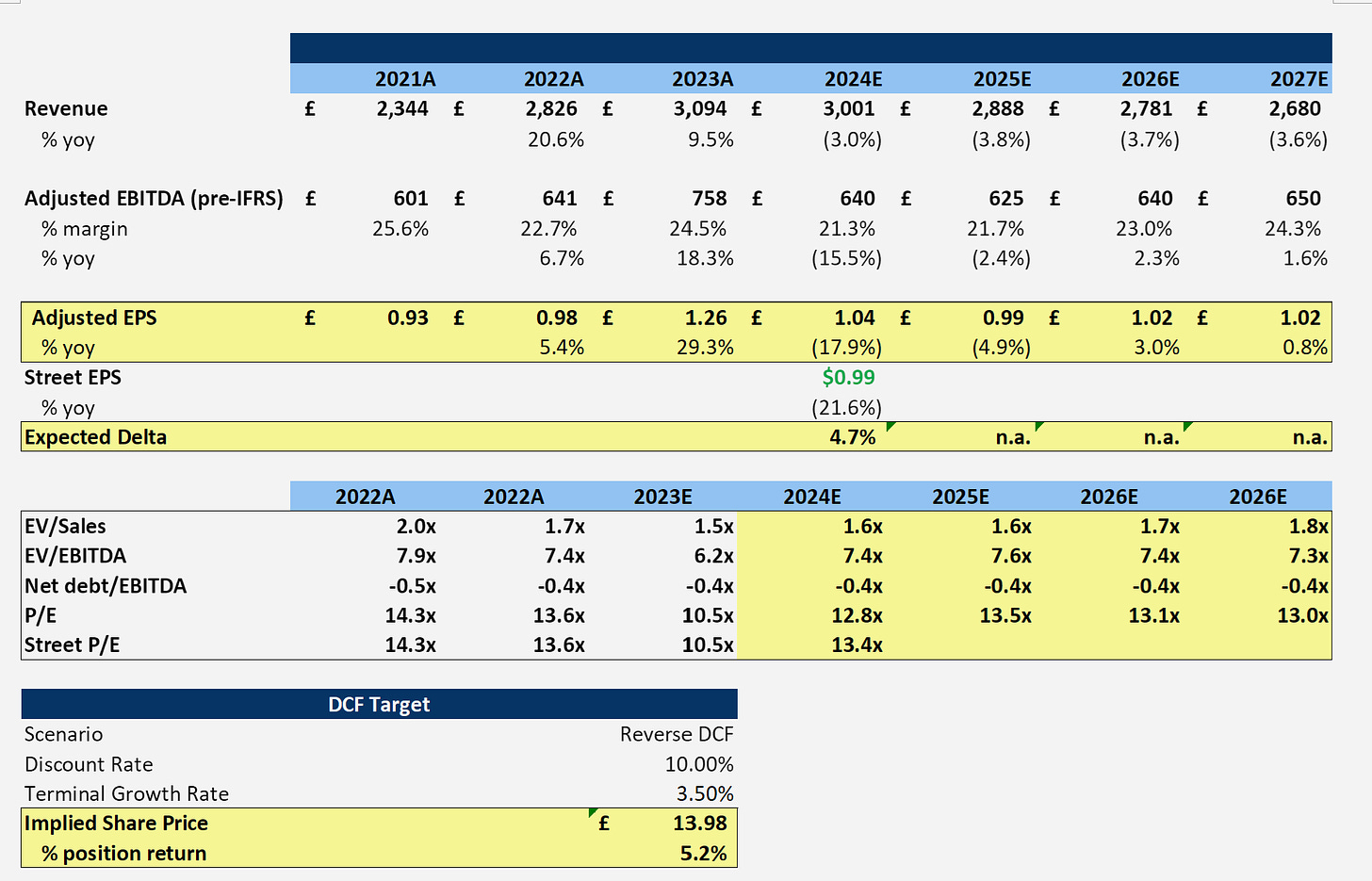

Reverse DCF analysis suggests that the market is implying a 4-year continuous decline of 5%~ topline revenue for Burberry. Which I believe not to be the case given the underlying luxury market structural growth discussed at the start of the article and Burberry’s new business turnaround strategy.

Concluding section

3 Key debates from an investment perspective:

1. Is Burberry’s current valuation attractive and has it priced on the downside already?

Burberry’s current valuation is quite attractive for investors willing to stomach the short-term volatility. It has already priced in the downside risk. I believe that Burberry’s intrinsic value is greater than its current market price. This is particularly highlighted through both the downside DCF, reverse DCF analysis and multiple analysis.

2. Is Burberry’s business turnaround plan going to succeed? And if it does is Burberry going to be able to make the transition from aspirational luxury to high-end luxury?

I believe Burberry’s business turnaround plan is likely to succeed and achieve management’s high-single-digit growth and 4 billion pounds medium-term revenue target because of the structural trends in the industry and Burberry’s unique British heritage. It is not as clear whether Burberry can transition to higher-end luxury under Daniel Lee’s and the new CEO Jonathan Akeroyd's leadership but returns in both scenarios are sufficiently attractive enough (42.5%~ in base case and 86~% in upside).

3. What is the opportunity cost of holding Burberry versus other luxury peers?

There are many other luxury companies that investors can gain exposure to should they believe in the underlying strength of the luxury market. This can be seen in LVMH, Hermes and many other luxury companies’ 20% gain at the start of this year when Burberry continued to decline. At its current state, Burberry is unlikely to capture the beta of this sector.

However, thinking from an IRR perspective, I believe that buying Burberry at this current valuation and selling it 3 years later after its business turnaround strategy will at least generate an IRR of 20%.

I think this IRR return is sufficient to compensate for the initial short-term returns that may be missed out for not investing in other luxury companies.

On the 3 conditions that Burberry’s current valuation is cheap, confidence in the business turnaround strategy, and opportunity cost is compensated for, I have entered a position in Burberry.

Select sources:

https://www.visualcapitalist.com/distribution-of-global-wealth-chart/

https://www.spglobal.com/spdji/en/indices/equity/sp-global-luxury-index/#overview

https://www.businessoffashion.com/community/people/daniel-lee

Other sources:

Business of Fashion x McKinsey State of Fashion 2023 Report

Burberry Annual Report and Transcripts

LVMH Investor Presentation

Various media

Legal disclaimer: THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security